free crypto tax calculator australia

Login to your Coinspot account. The tax year in Australia runs from the 1st of July to the 30th of June the following year.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

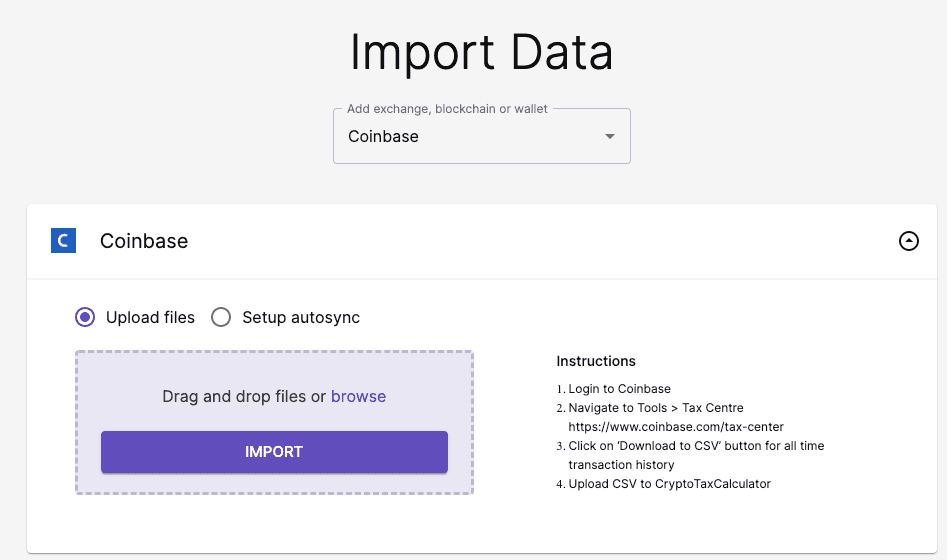

Create a report on crypto activity using a crypto tax calculator like Crypto Tax Calculator Australia.

. Fullstack Provides The Best Crypto Tax Calculator in Australia With Over 20 Years of Experience. The australian taxation office classifies cryptocurrency as an asset. At the top right click on the drop down menu on your account information and select Order History.

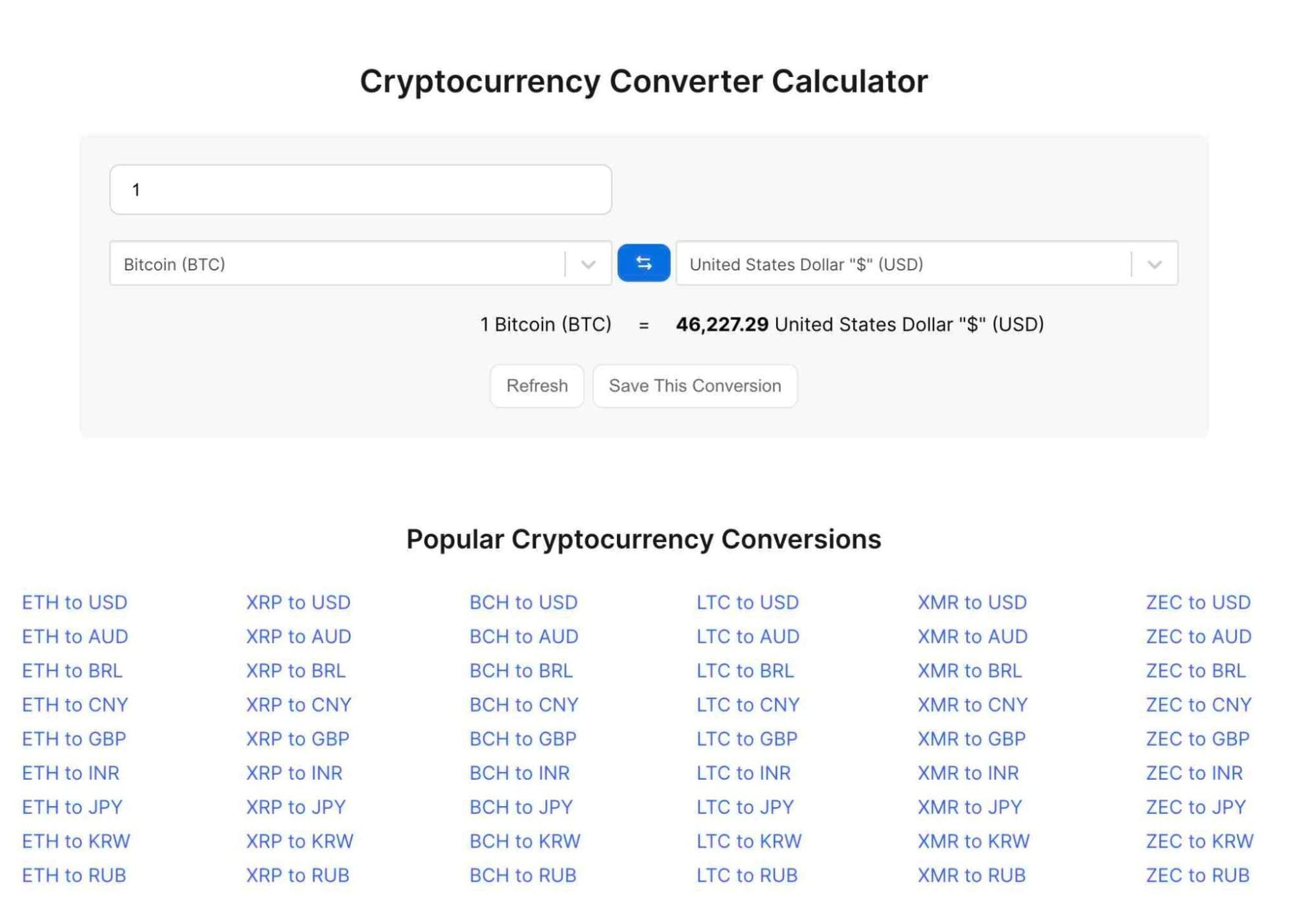

Use our free cryptocurrency tax calculator to calculate an estimate of how much capital gains tax you may need. Thats why it is a leading tax generator for retail investors. If you are completing your tax return for 20212022 you need to file your taxes by the 31st of October 2022.

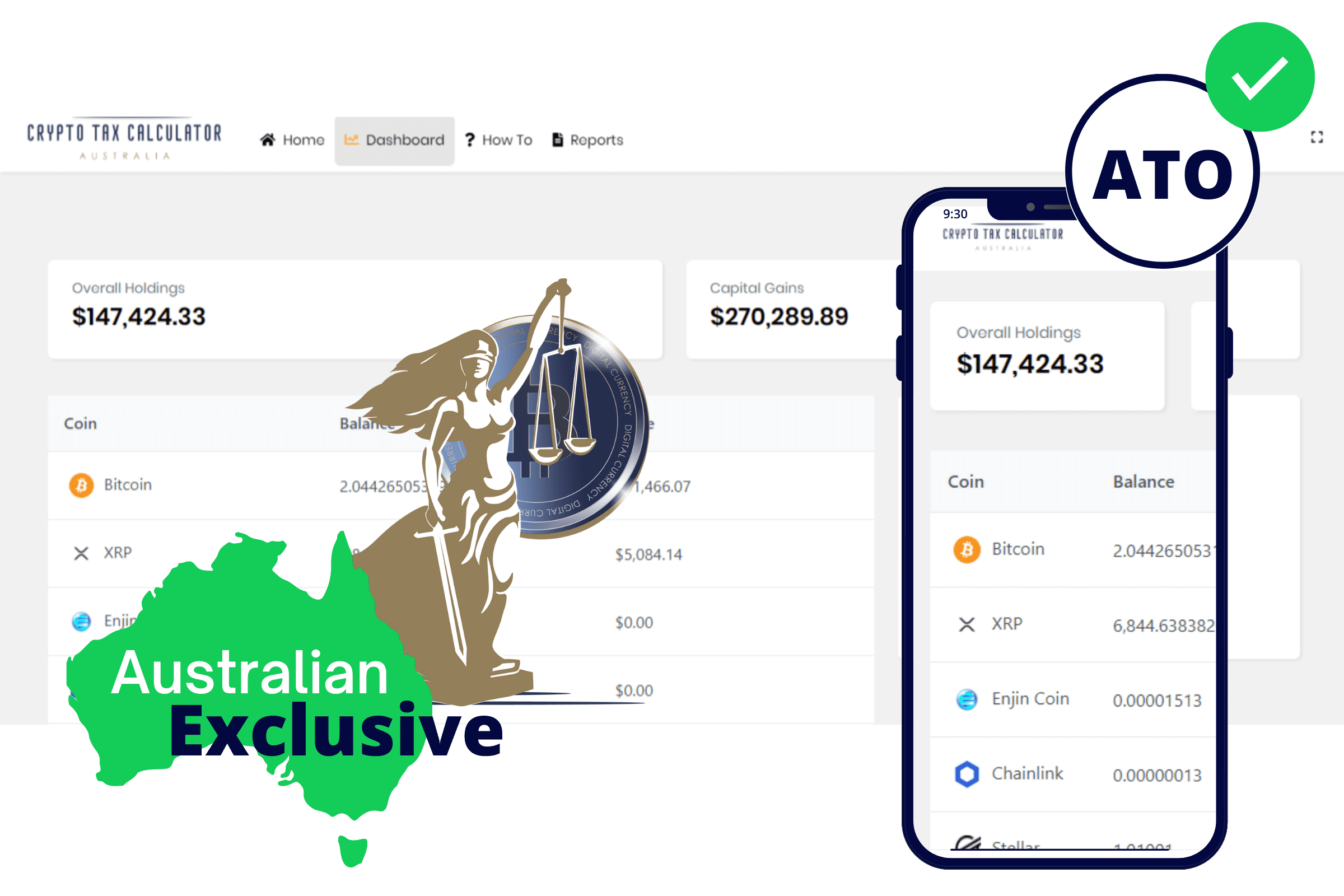

Our crypto tax calculator subscription is per financial yearYou can use our crypto tax application to generate as many reports as you wish per financial year along with previous financial years as well as using your personalised dashboard to track your cryptocurrency coins trades and capital gains. Crypto Tax Calculator Australia - Crypto Com Now Offers Free Crypto Tax Calcula Crypto Daily Yes you can cryptotaxcalculatoraustralia is designed to generate easy tax reports. Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year.

The TokenTax Crypto tax calculator. Ideally you should download a crypto tax report from your provider. We use this to.

With it cryptocurrency investors can manage their portfolio generate profit-loss statements file. Canada was its first supported jurisdiction followed by the United States and now Australia with plans to expand to other markets. Call 07 3088 9146.

Janes estimated capital gains tax on her crypto asset sale is 1625. Zenledger is the fastest and friendliest tax software for cryptocurrency investors and accountants. Click on this to download your CSV file.

Here are four strategies to successfully complete your crypto taxes. The tax rate on this particular bracket is 325. It offers a wide range of features including support for multiple exchanges and wallets and allows you to create custom reports.

Youll need to select YES on question 1 of the Taxpayers Declaration on your Tax return for individuals 2022 form the form used for income tax. Above your trades is a button that says BuysSells CSV. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

If the tax return is for a company trust or fund go. Crypto income is declared on question 2 of Tax return for individuals 2022 NAT 2541. Crypto tax deadline in Australia.

Youll need 2 forms one for income and one for capital gains. You can use our software to categorize all of your transactions and will only need to proceed to payment once you want to view your tax report. Crypto Tax in Australia - The Definitive 2022 Guide.

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. The CSV file will be saved to your device. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO.

Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly. If you are completing a tax return as or on behalf of an individual and lodging. Report CGT on crypto assets in your tax return.

CoinTracking also has a free plan for those with a small number. A record of all crypto purchases sales and interest earned. Is there a free trial I can try.

Online with myTax refer to instructions Capital gains or losses. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

On a paper form go to Part B Completing the capital gains section of your tax return. Remember that filing after the deadline can lead to penalties and fees. Here is a list of things you need before you lodge your crypto tax return with Etax.

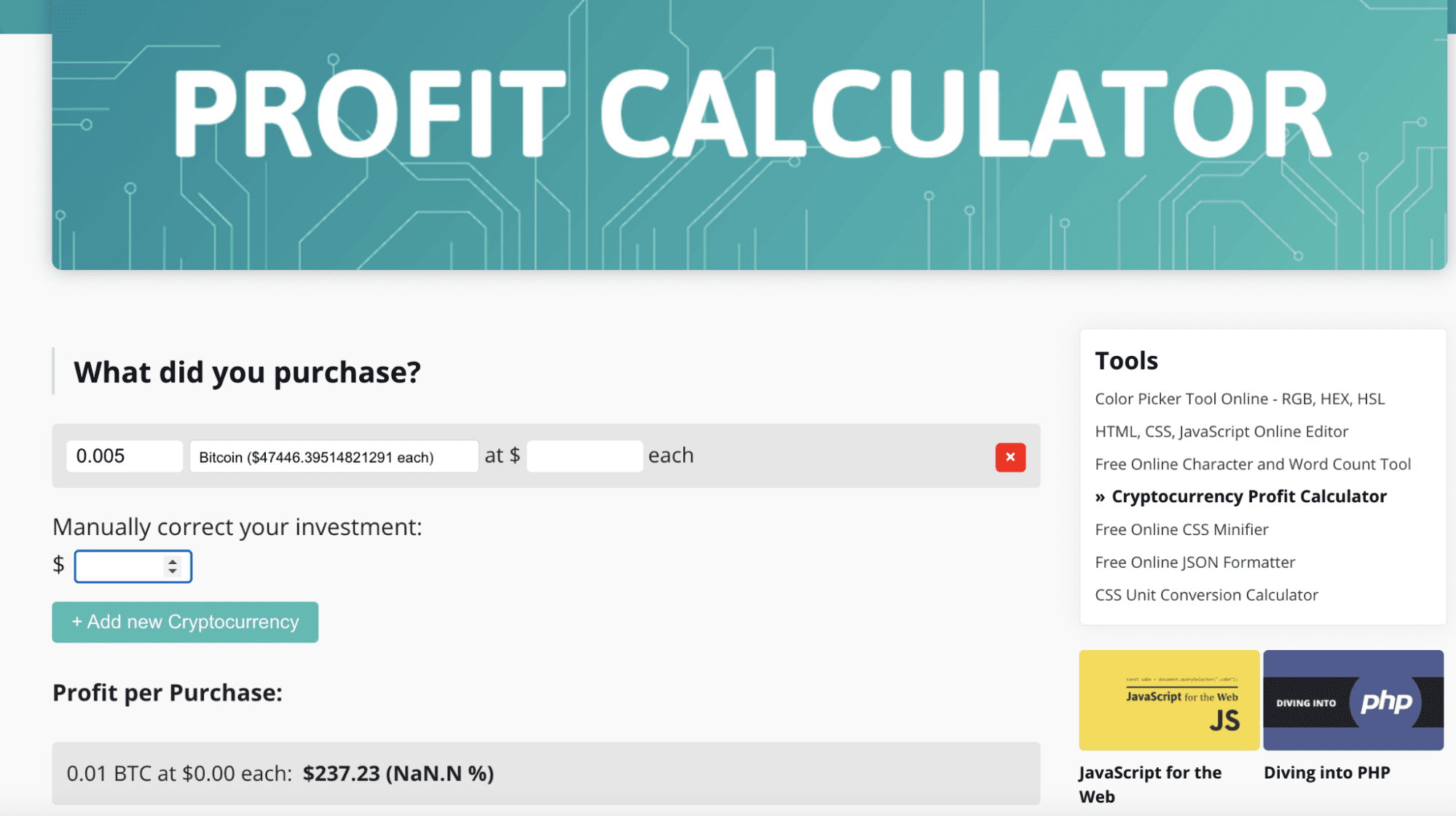

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. Get your crypto tax done today. Send the report to your accountant to complete your taxes.

CoinTracking is a good option for those who want more control over their crypto tax reporting. NFT Support Track all of your NFT trades. That way you can use our crypto tax calculator application today.

Although the popular exchange and payment platform didnt reveal which jurisdiction is next they will likely focus on where the majority of. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Well go through the easiest and most accurate technique first.

June 27 2022. 0325 5000 1625. Cryptocurrency is therefore subject to capital gains tax with few exceptions.

Plans Pricing All plans include coverage for every type of crypto transaction including but not limited to DeFi DEXs derivatives and staking as well as downloadable reports for all financial years under a single 365-day.

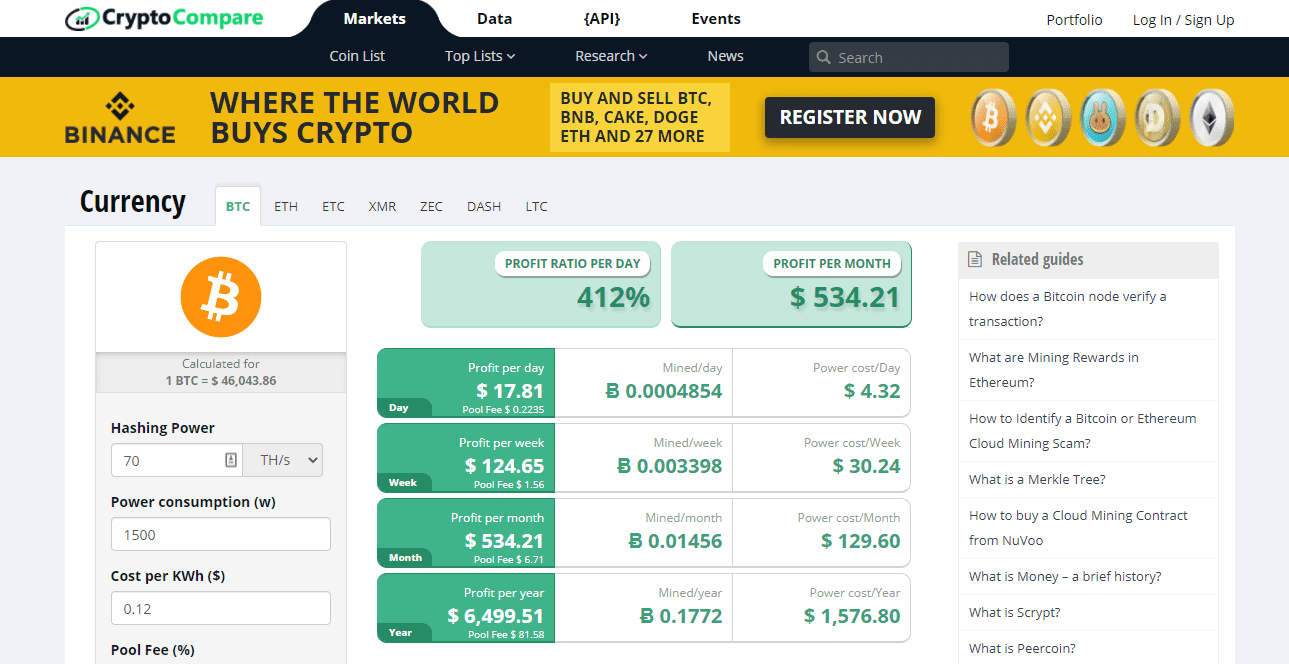

Best Cryptocurrency Calculator Mining Profit Taxes

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Bitcoin Price Prediction Today Usd Authentic For 2025

Follow Crypto Tax Calculator S Cryptotaxhq Latest Tweets Twitter

Cryptoreports Google Workspace Marketplace

Best Crypto Tax Software Top Solutions For 2022

10 Best Crypto Tax Software Apps 2022

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Best Cryptocurrency Calculator Mining Profit Taxes

How To Calculate Crypto Taxes Koinly

Best Cryptocurrency Calculator Mining Profit Taxes

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards